We told you so! Disney stocks drops to its lowest point in 7 months since Aug. 9th's third-quarter earnings call

Updated 9/05/16:

This year has not been very kind to The Walt Disney Company (NYSE: DIS), and so far, the only reliable news media outlet who has been able to accurately predict Disney's stock slide has been us.

As of last Friday, while the rest of the Dow Jones Index has risen 7.27% this year to 18,395.40, which puts it near its all-time high, only five Dow stocks have posted a share price decline for the year to date with Disney being the most prominent and biggest loser among that very small group of faltering companies.

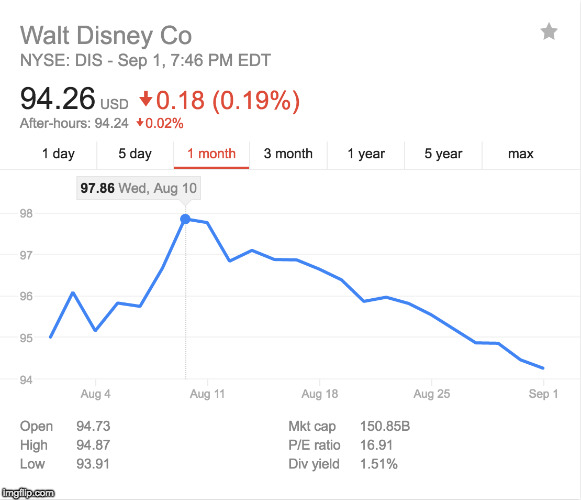

Disney's stock price has dropped 10% as of last Friday's closing bell with a closing price of $95.21 per share for the year to date, making it by far the worst performing Dow Jones Industrial Average stock thus far this year. As of end of the closing bell today, the stock price has dropped even lower to a 7-month low of $94.26 per share.

Not so long ago, Disney's traditional media mix of theme parks, movie studios, TV networks, consumer products, and ESPN in its portfolio made it the financial darling among many Wall Street investors.

But lately, it seems traditional media companies dealing in the old-fashioned TV, cable, movies, newspapers, and radio are most definitely on the decline, especially in the face of a fast-changing digital landscape which has uprooted, disrupted and in some cases completely supplanted the traditional means of distribution and exhibition for various mass media shows, ad revenue streams, products, and services.

Many experts now see Disney's business model as being too slow to react and overly reliant on its cable ESPN Networks as its major cash-cow, which in turn has mostly relied upon an outdated cable TV bundle subscription fee model to generate the majority of its revenues.

As a result of the fast changing digital landscape, we have seen Disney's revenue growth turn decisively sluggish in the last two fiscal quarters.

Net revenue in its media networks segment, which includes Disney's single largest cash-cow ESPN, was essentially flat at $2.371 billion.

And Disney's biggest cash-cow, ESPN, is reported to have lost over 7 million cable subscribers and about $1.3 billion in revenues between 2013 and 2105, according to Sports Illustrated.

With few other promising catalysts for future growth, investors have begun to turn away from the House of Mouse as a long-term investment that has little potential for much future growth. There's just simply nothing in the pipeline at Disney to justify seeing revenues grow much in the foreseeable future.

Disney's billion-dollar investment in an on-demand sports video streaming company like BAMTech is not poised to embrace cord-cutters who are turning away from their expensive cable bundle subscriptions.

ESPN will always protect its rights to exhibit its premium sporting events exclusively on its cable channels by limiting access to premium live sporting events on on-demand digital streaming services.

That's because online fees from on-demand streaming services could never make up the kind of money that cable bundle subscriber-based carrier fees can make for a cable sports channel included in a cable lineup where the major of subscribers don't even watch the channel but still have to pay for it.

Thus, Disney's foray into digital on-demand video services is at best a disingenuous attempt to dip their toes into the digital waters to soothe fears from investors who still worry about ESPN's revenues dipping from cable subscriber losses.

In essence, Disney will likely never again have the kind of unchecked cash-cow it has had with ESPN in the past when expensive multi-channel cable TV bundled packages were king, and many Wall Street investors are now beginning to fully comprehend the impact that ESPN had on the fortunes of the Disney empire over the years.

The founder of the group and China's richest man announced he's intent on trouncing Disney at its own game by announcing his intent on building a $9.5 billion tourism and sport complex, complete with hotels and a theme park, in the eastern China city of Jinan.

The proposed entertainment complex nearly doubles the price of Shanghai Disneyland, which in comparison costs merely $5.5 billion, and will thus position Dalian Wanda to cover more theme parks in China, both by number and variety, which cover both more affordable and more opulent entertainment offerings for Chinese tourists than Disney. This appears to be a winning formula.

And finally the problems of the Zika virus outbreak in Florida have even Disney executives worried about losing a significant number of tourists to Central Florida who are worried about contracting the disease from locally-infected mosquitoes.

Disney World has already suffered a significant drop in visitors this year for a number of reasons, but it seems the Zika scare is by far the biggest threat to tourism to Florida.

Without a way to stop the outbreak of the virus from reaching the local mosquito populations, it may be years before any solution can stop the virus from becoming a major endemic pandemic in the entire southern Gulf state region.

So thus, even now bargain hunters are starting to shy away from buying Disney stock as an impending deep selloff may soon be under way. No one knows how low the floor will be for Disney stocks when the sell-off begins, however.

The recent slide in Disney stocks after the third-quarter earning call at the end of the closing bell on August 9th is just too ominous to ignore. Buying now is just not prudent for any investor if the potential for the stock to drop much lower tomorrow is a very real possibility.

This year has not been very kind to The Walt Disney Company (NYSE: DIS), and so far, the only reliable news media outlet who has been able to accurately predict Disney's stock slide has been us.

|

| Disney stock prices has been completely underwater since its third-quarter earnings call back after the closing bell of August 9, 2016 |

Disney's stock price has dropped 10% as of last Friday's closing bell with a closing price of $95.21 per share for the year to date, making it by far the worst performing Dow Jones Industrial Average stock thus far this year. As of end of the closing bell today, the stock price has dropped even lower to a 7-month low of $94.26 per share.

Not so long ago, Disney's traditional media mix of theme parks, movie studios, TV networks, consumer products, and ESPN in its portfolio made it the financial darling among many Wall Street investors.

But lately, it seems traditional media companies dealing in the old-fashioned TV, cable, movies, newspapers, and radio are most definitely on the decline, especially in the face of a fast-changing digital landscape which has uprooted, disrupted and in some cases completely supplanted the traditional means of distribution and exhibition for various mass media shows, ad revenue streams, products, and services.

As a result of the fast changing digital landscape, we have seen Disney's revenue growth turn decisively sluggish in the last two fiscal quarters.

Net revenue in its media networks segment, which includes Disney's single largest cash-cow ESPN, was essentially flat at $2.371 billion.

And Disney's biggest cash-cow, ESPN, is reported to have lost over 7 million cable subscribers and about $1.3 billion in revenues between 2013 and 2105, according to Sports Illustrated.

With few other promising catalysts for future growth, investors have begun to turn away from the House of Mouse as a long-term investment that has little potential for much future growth. There's just simply nothing in the pipeline at Disney to justify seeing revenues grow much in the foreseeable future.

| Are the days of Disney's cash-cow in ESPN from cable-bundle subscription fees over? |

That's because online fees from on-demand streaming services could never make up the kind of money that cable bundle subscriber-based carrier fees can make for a cable sports channel included in a cable lineup where the major of subscribers don't even watch the channel but still have to pay for it.

Thus, Disney's foray into digital on-demand video services is at best a disingenuous attempt to dip their toes into the digital waters to soothe fears from investors who still worry about ESPN's revenues dipping from cable subscriber losses.

In essence, Disney will likely never again have the kind of unchecked cash-cow it has had with ESPN in the past when expensive multi-channel cable TV bundled packages were king, and many Wall Street investors are now beginning to fully comprehend the impact that ESPN had on the fortunes of the Disney empire over the years.

The founder of the group and China's richest man announced he's intent on trouncing Disney at its own game by announcing his intent on building a $9.5 billion tourism and sport complex, complete with hotels and a theme park, in the eastern China city of Jinan.

The proposed entertainment complex nearly doubles the price of Shanghai Disneyland, which in comparison costs merely $5.5 billion, and will thus position Dalian Wanda to cover more theme parks in China, both by number and variety, which cover both more affordable and more opulent entertainment offerings for Chinese tourists than Disney. This appears to be a winning formula.

Disney World has already suffered a significant drop in visitors this year for a number of reasons, but it seems the Zika scare is by far the biggest threat to tourism to Florida.

Without a way to stop the outbreak of the virus from reaching the local mosquito populations, it may be years before any solution can stop the virus from becoming a major endemic pandemic in the entire southern Gulf state region.

The recent slide in Disney stocks after the third-quarter earning call at the end of the closing bell on August 9th is just too ominous to ignore. Buying now is just not prudent for any investor if the potential for the stock to drop much lower tomorrow is a very real possibility.

And Disney's very low 1.48% dividend yield, the third stingiest among all 30 Dow Jones stocks, is just another reason long-term investors are taking a pass on buying Disney stocks.

The stock has been steadily sliding ever since the mixed revenue report from Disney management in the third quarter, and many bargain hunters have been burned because there is no indication that Disney stocks will bounce back anytime soon for any sustained stretch of time.

Articles published after our article:

- Amigo Bulls: Will Walt Disney Co Stock Fall Below $90? (9/12/16)

- Seeking Alpha: 3 Reasons Why Disney Could Be A Mouse Trap (9/09/16)

- Benzinga: Disney Shares Are On Track To Become The Largest Dow 30 Laggard (9/09/16)

- Investopedia: A Look at Disney's Fundamental, Technical Drivers (DIS) (9/09/16)

- CNBC: Disney shares are doing something new — and very disappointing (9/09/16), with video

- Motley Fool: No, ESPN Isn't Winning Back Subscribers Yet (9/08/16)

- Street: Analysts Discuss Disney's (DIS) Decline (9/08/16)

- CNBC Video: Disney: Worst Dow stock YTD (9/08/16)

- Seeking Alpha: Disney: Can Mickey Make It To Street's FY '17 EPS Target? (9/06/16)

- The Street: As Summer Ends, Disney's Stock Sits at a Crossroads (9/01/16)

Sources:

- International Business Times: Zika Virus At Walt Disney World? Amusement Parks In Orlando And Tampa Bay Distribute Insect Repellent (8/29/16), with video

- CBC: Zika outbreak: Disney World, Orlando theme parks offer free bug spray (8/29/16)

- Quartz: China’s richest man, Wanda Group CEO Wang Jianlin, has declared war on Disneyland (8/29/16)

- WFTV: Disney giving out free insect repellant to help keep visitors safe from Zika (8/29/16), with video

- WFLA: Florida theme parks offer free mosquito repellent in fight against Zika (8/29/16), with video

- Fox News: Florida theme parks offering free bug spray amid growing Zika fears (8/29/16)

- WESH: Orlando theme parks offering free mosquito repellent (8/28/16), with video

- CNN: Amid Zika fears, Florida theme parks offer mosquito repellent (8/28/16), with video

- WTSP: Theme parks offer free repellent in Zika response (8/28/16), with video

- Gizmodo: Walt Disney World Won't Say The Word Zika (8/28/16)

- WESH: Amid Zika fears, Fla. theme parks offer repellent (8/27/16)

- WKMG: Disney, Universal, Sea World provides free insect repellent as Zika scare rises (8/27/16), with video

- 24/7 Wall St.: Disney Is DJIA's Worst Performing Stock, Down More Than 9% (8/27/16)

- Barron’s: Sell Disney, Buy Viacom and Netflix (8/27/16)

- WKMG: Disney World provides free insect repellent as Zika scare rises (8/27/16)

- Laughing Place: Walt Disney World to Offer Free Insect Repellent to Guests as Zika Precaution (8/27/16)

- Theme Park Insider: Orlando theme parks to start giving out free insect repellent (8/27/16)

- WLS-TV: Disney World to provide free mosquito repellent for Zika prevention (8/27/16)

- WPBF: Disney World offering free insect repellent for Zika preparedness (8/27/16)

- Orlando Sentinel: Disney, Universal, SeaWorld to start providing free mosquito repellent as Zika comes closer (8/27/16), with video

- The Street: Disney Is in Danger of a Deep Selloff (8/26/16)

- Skift: Disney Rival Wanda’s Latest Move Is a $9.5 Billion Tourism Project in China (8/26/16)

- Fortune: China's Richest Man Has a New $9 Billion Plan to Crush Disney (8/26/16), with video

- BBC: Media dismisses claims Disney has turned dismal in China. (8/11/16)

- 24/7 Wall St.: Disney Drops 8% as Worst Performing Dow Stock (8/21/16)

- Disney's 'Pete's Dragon' underwhelmed in its opening weekend, making it 3 of 4 of Disney's tent pole movies that stumbled in the summer Hollywood box office derby (8/15/16)

- Judgment day: Quarterly earnings for Disney largely disappoint as predicted and result in a drop in Disney stock prices in after hours trading (8/09/16)

- Bearish forecasters brace for Disney stock to tank as earnings expected to fall well short of Wall Street expectations again during Disney's next quarterly earnings call (8/03/16)

- 5 Reasons Disney World Attendance is Falling (7/31/16)

- Disney's World War Z: Forget about scary gators; deadly mosquitoes are now confirmed for spreading a pandemic of the Zika virus in Florida (7/20/16)

- Sports Illustrated: ESPN to cater to cord-cutters with limited streaming service (7/12/16)

- Disney finally has a plan to offer live streaming video service online for ESPN, but critics already see it as half-baked (7/12/16)

- Disney's summer tent poles 'The BFG' and 'Pete's Dragon' expected to bomb, showing dramatic shift in Hollywood's ability to draw in audiences to the cineplex (7/01/16)

- Brexit, Zika, Brazil, and upcoming Rio Summer Olympics—but not so much gators—slam prospects of tourism to Disney World and send Disney stocks plummeting downward (6/25/16)

- Disney's failure to reach a deal with Beijing in establishing a significant media presence inside China may sink its hopes for success in its $5.5B 'distinctly communist' theme park (6/19/16)

- Shanghai Disneyland Could Lose Money for Years (6/14/16)

- How will Disney perform in 2016? There are some serious concerns from many shareholders about Disney's future (6/04/16)

- Travel advisory: Tourists warned to 'think twice' about visiting Walt Disney World in Florida over Zika scare (5/30/16)

- Box Office: Disney's 'Alice Through The Looking Glass' Bombs With $9.8M Friday (5/28/16)

Comments

Post a Comment