|

| Disney CEO Bob Iger has promised growth in 2017, but there's still nothing in the pipeline at Disney to deliver on that empty promise |

| Disney officials have been less than honest and forthcoming of late in their quarterly earning calls about how badly the company has been doing |

While a lot of Wall Street analysts blamed why Disney's earnings have been staggering this past year on the continuing woes at ESPN and ABC television networks, Disney has had many other problems that have made this year one to forget for the Mouse.

But let's start with the woes at ESPN and ABC since they figure so prominently in Disney's earnings slump for 2016.

| All of Disney's business divisions, except for its movie studios, had tanked in 2016 |

Over the past five years, ESPN has shed some 10 million subscribers, and more alarmingly, ESPN lost a record 621,000 subscribers in the month of October alone, according to data from Nielsen.

The cord-cutting phenomena among cable bundle subscribers tired of paying for expensive channel in the basic lineup they never watch fully explains why revenues at ESPN fell by 7% and operating income by 13% this year.

What's made this number worse is that ratings for NFL football has also dropped precipitously this year, which many people believe is being caused by the presidential election coverage, viewer boycotts from national anthem protests led by Colin Kaepernick, and growing concerns from parents about injuries the sport may cause on their children if they participate in the sport.

This season, network viewership in NFL football is down about 10% compared to last season, according to data from A.C. Nielsen, with much steeper declines for prime-time games on Sunday, Monday, and Thursday.

ESPN's Monday Night Football has taken a particularly big hit with more than 17% drop in ratings compared to a year ago which makes it the biggest loser among the primetime NFL broadcasters. Average viewership on Monday Night Football is now only 11.3 million with a drop of 24% among the key demographic group of men aged 18 to 34 years of age.

On top of that, NBA basketball will be increasing its broadcasting rights fees next year by more than $600 million, increasing programming costs for ESPN by more than 8% for fiscal 2017. This is the same old story of higher costs and lower revenues at the all-sports network.

Operating income for the Disney's cable networks overall fell $207 million for the fourth quarter due to same theme of lower ad and affiliate revenue and higher programming and production costs.

Not only has cord-cutting finally caught up to ESPN in a big way, but toward the end of the year, Disney's other major profit-generating juggernaut, ABC Networks, has seen a continuing steady decline in rating and advertising revenue.

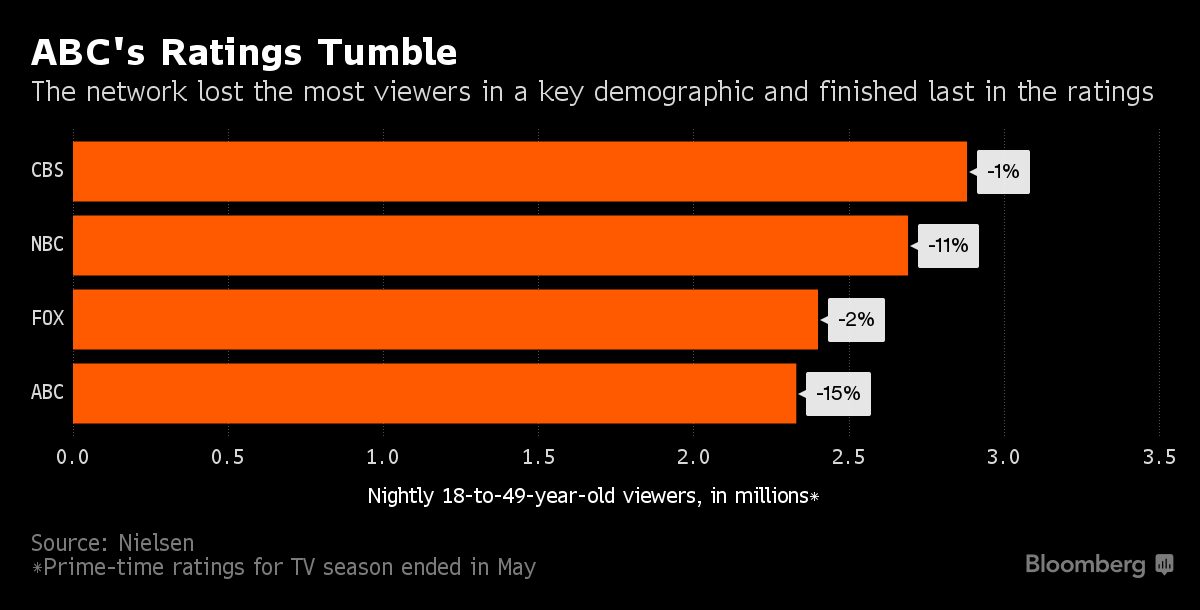

ABC networks has been in a two-seasons-long ratings free fall with rating down 9% in overall viewership and down 13% in the all-important ratings demographic of adult 18-49-years-old (1.9 rating) compared to a year ago, according to A.C. Nielsen.

That places ABC distinctly in third place, behind CBS and NBC in total viewership among the major broadcasting networks.

The problem with ABC is that its primetime lineup is remarkably thin and largely irrelevant to the American consciousness, so it's no surprise that advertisement revenue from ABC is significantly down this year, despite Disney trying to make up the difference by increasing affiliate fees.

| NFL football rating have been down significantly this year |

On top of that, NBA basketball will be increasing its broadcasting rights fees next year by more than $600 million, increasing programming costs for ESPN by more than 8% for fiscal 2017. This is the same old story of higher costs and lower revenues at the all-sports network.

Operating income for the Disney's cable networks overall fell $207 million for the fourth quarter due to same theme of lower ad and affiliate revenue and higher programming and production costs.

|

| ABC is dead last in a very key advertising demographic, adults 18 to 49-year-olds |

That places ABC distinctly in third place, behind CBS and NBC in total viewership among the major broadcasting networks.

The problem with ABC is that its primetime lineup is remarkably thin and largely irrelevant to the American consciousness, so it's no surprise that advertisement revenue from ABC is significantly down this year, despite Disney trying to make up the difference by increasing affiliate fees.

Disney's flagship Disney Channel also lost an equally impressive number of subscribers as ESPN has. Subscribers to the Disney Channel fell to 93 million by the end of fiscal year 2016, down from 97 million in 2014.

Disney's theme parks and resorts segment did not fare much better in 2016. In the fourth fiscal quarter ending on October 1, Disney reported that U.S. theme parks (Disneyland Anaheim and Walt Disney World) attendance numbers dropped by a whopping 10% from a year ago.

While Disney adamantly denies this, the Zika virus scare had a lot to do with the declining attendance numbers as the virus had even hurt Disney Cruise Line's bottom line and will likely continue to do so for years to come until some form of vaccine available to the public is developed.

Disneyland Paris and Hong Kong Disneyland also reported heavy declines in attendance. While Disney did not provide any hard numbers, Themed Entertainment Association (TEA) had reported attendance at Hong Kong Disney fell by more than 9.3% in 2015, compared to the previous year, and occupancy at Disney's two Hong Kong hotels declined by more than 13 percent.

This was all caused by a sharp drop in tourism from mainland China after volatile upheavals in China's stock market over the past few years. The opening of Shanghai Disneyland in mainland China didn't help matters much for Hong Kong Disney as the two Chinese Disney theme parks are now direct competitors to one another.

Disneyland Paris didn't fare much better in the wake of continuing terrorist threats in France and all over Europe. In fact, the threat of a terrorist attack directly at Disneyland Paris has only become more real with time.

Attendance at Disney Paris is down 10%—on par with numbers in Disney's U.S. theme parks—and revenues have declined by more than 7%.

Disney Paris has lost about $1.1 billion over the last three years, including $903 million this fiscal year, ending on Sept. 30.

The situation is so bad in Paris that Disney, which has an 81% ownership stake in the resort, waived its management fees and royalties from its partner, Euro Disney, through mid-2018.

Last year, Disney collected $87.4 million in fees and royalties from Euro Disney, and was scheduled to take $22.1 million in the final quarter; however, that all of those fees and royalties are off the table for now.

Thus, all of Disney's established theme parks are tanking, and given that Disney could only eke out a 1% increase in revenue from the theme parks and resorts segment in the 4th quarter—despite the fact they added an entire new theme park in Shanghai this year—it shows just how bad Disney's theme parks had performed in 2016.

Consumer products and digital media performed even worse than media networks or theme parks as revenues slid by more than 17% in the fourth quarter. It's gotten so bad that Disney cut more than 250 jobs or 5 percent of the workforce in consumer products in September.

Outside of its booming movie studios segment, which is only the third most profitable business segment inside of the House of Mouse, there is much more to worry about from Disney than just its fortunes in media networks of late. 2016 was truly a year to forget for Disney, and there isn't much in the pipeline to look forward to in 2017.

That may be why many Wall Street brokerage firms and analysts, such as BTIG Research, of late are now recommending to sell the stock.

| Attendance numbers at all of Disney's established theme parks and resorts, including Disney Cruise Line, have been down significantly this year |

While Disney adamantly denies this, the Zika virus scare had a lot to do with the declining attendance numbers as the virus had even hurt Disney Cruise Line's bottom line and will likely continue to do so for years to come until some form of vaccine available to the public is developed.

Disneyland Paris and Hong Kong Disneyland also reported heavy declines in attendance. While Disney did not provide any hard numbers, Themed Entertainment Association (TEA) had reported attendance at Hong Kong Disney fell by more than 9.3% in 2015, compared to the previous year, and occupancy at Disney's two Hong Kong hotels declined by more than 13 percent.

| Highly credible terrorist threats to Disneyland Paris have and will continue to hurt attendance numbers to Disneyland Paris well into fiscal 2017 |

Attendance at Disney Paris is down 10%—on par with numbers in Disney's U.S. theme parks—and revenues have declined by more than 7%.

Disney Paris has lost about $1.1 billion over the last three years, including $903 million this fiscal year, ending on Sept. 30.

The situation is so bad in Paris that Disney, which has an 81% ownership stake in the resort, waived its management fees and royalties from its partner, Euro Disney, through mid-2018.

|

| Disney earnings projections were down and out in 2016 and likely will continue on the same trajectory well into 2017 |

Consumer products and digital media performed even worse than media networks or theme parks as revenues slid by more than 17% in the fourth quarter. It's gotten so bad that Disney cut more than 250 jobs or 5 percent of the workforce in consumer products in September.

Outside of its booming movie studios segment, which is only the third most profitable business segment inside of the House of Mouse, there is much more to worry about from Disney than just its fortunes in media networks of late. 2016 was truly a year to forget for Disney, and there isn't much in the pipeline to look forward to in 2017.

Sources:

- Market Realist: ESPN, ABC, and More: Disney's Media Networks in Fiscal 2017 (11/28/16)

- Is Disney’s ESPN in Trouble?

- Why Disney Is Still Bullish about ESPN

- Will Disney’s ESPN Advertising Keep Falling in Fiscal 1Q17?

- Why Disney Expects Programming Costs to Rise

- Disney’s Cable Networks: What You Can Expect for Affiliate Fees

- What Disney Thinks of Hulu’s Proposed Online TV Service

- Will Disney Launch DisneyLife in the United States?

- Could Disney Be Interested in Acquiring Netflix or Twitter?

- Why Disney Believes in Focusing on Tech

- Disney’s Key Financial Metrics: Let’s Take a Look

- WSJ: Activist Investor Accuses Euro Disney of Magic in Accounting (11/25/16)

- French police uncover ISIS sleeper cell in terrorist plot to attack Disneyland Paris, Champs-Elysées on December 1st (11/25/16)

- TheStreet: Disney Has Other Problems Besides Falling ESPN Subs (11/24/16)

- Motley Fool: The Walt Disney Company Bought Back 74 Million Shares in 2016 — Should Investors Be Happy? (11/23/16)

- WSJ: ESPN Lost Two Million Subscribers in Fiscal 2016 (11/23/16)

- Deadline: ESPN’s Domestic Subs Fell 2.2% This Year To 90M, Disney Reports (11/23/16)

- Breitbart: ESPN subscriber loss hurt Disney, sports giant continues rapid decline (11/23/16)

- Variety: ESPN, ABC Continue to Be a Drag on Disney Earnings Growth (11/22/16)

- Fox News: ESPN Subscriber Losses Finally Take Their Toll at Walt Disney Co (11/21/16)

- Fox News: Disneyland Paris sees record low attendance amid terrorism concerns (11/15/16)

- Motley Fool: ESPN Lost a Record Number of Subscribers in October. What Does It Mean for Disney? (11/14/16)

- Seeking Alpha: Can Disney Overcome Its ESPN Burden? Sort Of (11/13/16)

- Cinema Blend: ESPN May Be In More Trouble Than We Thought (11/11/16), with video

- Nasdaq: ESPN Issues Weigh On Disney's Q4 Earnings (11/11/16)

- Forbes: Disney's ESPN Subscriber Situation Is A Cause For Concern (11/11/16)

- WSJ: CMO Today: ESPN Struggles Amid Subscriber Decline (11/11/16)

- Newsweek: DISNEYLAND PARIS POSTS RECORD LOSSES IN YEAR AFTER TERROR ATTACKS (11/11/16), with video

- Seeking Alpha: Disney's Weakness Extends Beyond ESPN; Should We Be Worried? (11/11/16)

- Time: This Is the Biggest Threat to Disney’s Business Right Now (11/10/16)

- Disney in serious trouble as they miss earnings projections for the second time in the last three quarters (11/10/16)

- Disney's cable demise begins: DISH offers Sling with and without ESPN, effectively making it à-la-carte, so Disney is now scrambling to find a new digital distribution strategy (10/14/16)

- As DIS stock prices continue to slide, Disney ponders acquiring a multi-billion dollar high tech media company to reassure investors that its best days are not behind them (10/11/16)

- Disney doubles down on claims that Disney World has seen no fallout from the Zika scare despite a notable drop in park attendance (9/16/16)

- We told you so! Disney stocks drops to its lowest point in 7 months since Aug. 9th's third-quarter earnings call (9/1/16)

- Disney's 'Pete's Dragon' underwhelmed in its opening weekend, making it 3 of 4 of Disney's tent pole movies that stumbled in the summer Hollywood box office derby (8/15/16)

- Judgment day: Quarterly earnings for Disney largely disappoint as predicted and result in a drop in Disney stock prices in after hours trading (8/09/16)

- Bearish forecasters brace for Disney stock to tank as earnings expected to fall well short of Wall Street expectations again during Disney's next quarterly earnings call (8/03/16)

- 5 Reasons Disney World Attendance is Falling (7/31/16)

Comments

Post a Comment