|

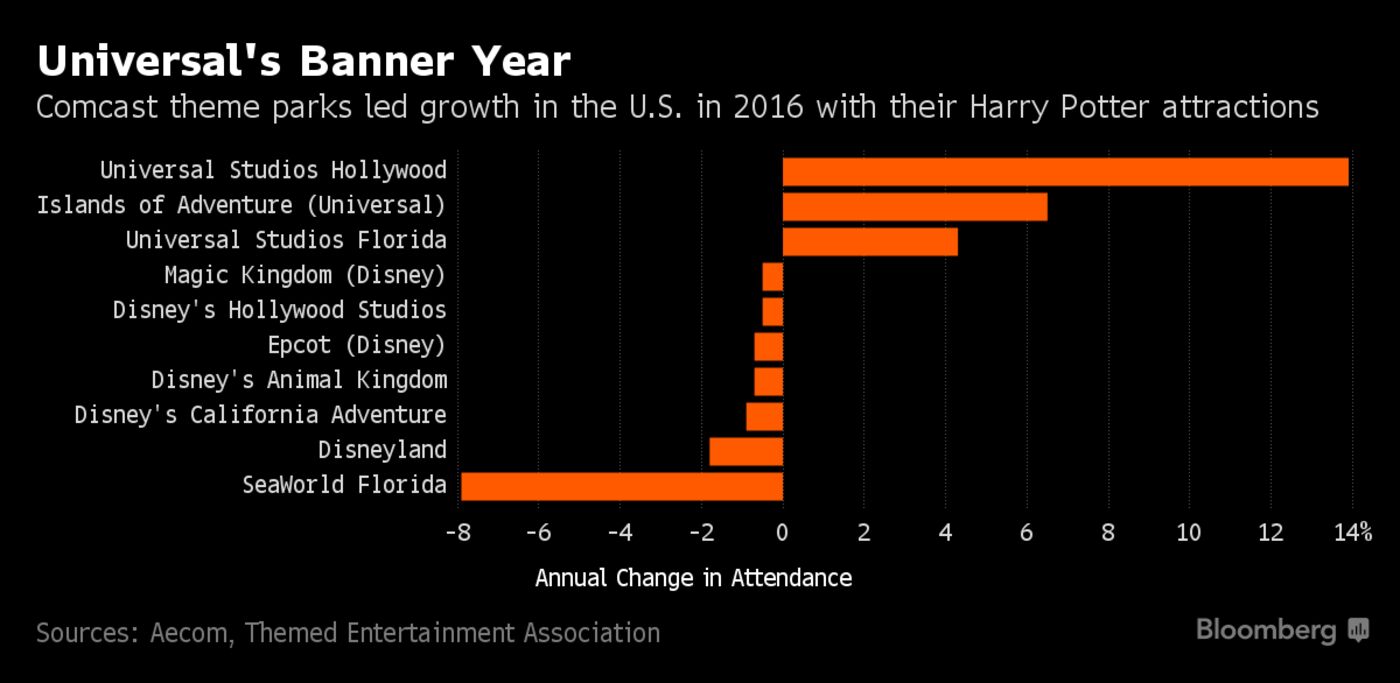

| The bar graph above from Bloomberg shows that attendance has declined in all of Disney's U.S. theme park operations |

|

| The TEA survey shows a not so bright picture of Disney's theme parks operations |

Attendance at Walt Disney World's Magic Kingdom, in Orlando, Florida, was down 0.5% from 2015. California's Disneyland fared far worse with attendance dipping 1.8% compared to 2015. Epcot in Orlando, Florida was down 0.7% from the previous year. Attendance at Walt Disney World's Animal Kingdom was down 0.7%. Disney's Hollywood Studios in Florida was down 0.5%. And attendance at Disney California Adventure in Anaheim, California was down 0.9% from 2015. (See bar graph above on changes in attendance number in all the major U.S. theme parks above and the numbers below.)

Disney's domestic waterparks were not immune to the sagging interest seen in Disney's Florida theme parks and resorts operations.

Attendance at Walt Disney World's two waterparks, Typhoon Lagoon and Blizzard Beach, were down 0.7% and 0.8%, respectively, despite the fact that attendance at the top 20 waterparks in the world grew by 3.6% from the previous year.

|

| It's official: Mickey Mouse is depressed |

Disneyland Shanghai only drew 5.6 million visitors, from the world's most populous country, in its first year of operation, landing it only 21st on the TEA/AECOM list. These anemic numbers are less than stellar from the second richest economy on earth.

Attendance at Tokyo Disneyland slid 0.4% from 2015, while its sister park Tokyo DisneySea saw a 1.0% dip in attendance last year. Disneyland Paris fared far worse, dipping more than an immense 14.2% in attendance from the previous year, while its sister park Walt Disney Studios Paris saw a more modest 1.6% decline in attendance during the same period last year. And rounding out Disney's disastrous 2016 attendance numbers, Hong Kong Disneyland saw a whopping 10.3% dip in its attendance numbers compared to the previous year.

There's no doubt that Disney's international theme parks and resorts operations were a complete flop and tanked overall in attendance, revenue and profits last year which would give any investor pause for concern regarding the financial health of the Walt Disney Corporation in the larger scheme of its many different synergistic business operations.

While Disney is boasting a 9% increase in revenues year-to-year in its theme parks and resorts operations, this number is misleading because, for fiscal year 2015, Disney did not have the benefit of a sixth theme park resort in the form of the new Shanghai Disneyland to contribute to additional revenues.

By this argument if we apply simple mathematics to the equation, Disney's sixth theme park resort should have increased its segment revenues by at least 1/6th or 16.7%, if the segment was truly prospering as Disney executives want you to believe, instead of the sluggish 9% increase Disney is touting from the year before.

Thus, by this reasoning, Disney's theme parks operations underperformed by about 6.7% year to date.

This assumption is fair given the fact that their newest theme park in mainland China opened to a great deal of hoopla and publicity in the most populous and second most richest country on earth.

Thus, the downturn in overall attendance numbers in theme park attendance—especially in the international theme park operations—is quite concerning if we factor out the contributions from even the disappointing numbers from Shanghai Disneyland.

To give perspective to Shanghai Disney's "much-touted success" in drawing 11 million visitors in its first year of operation in the most populous country in the world, those numbers would rank Shanghai Disneyland alongside Disney World's least popular theme park, Disney's Hollywood Studios, in terms of popularity, whose admission ticket prices are 20-25% higher than in Shanghai.

Thus, it appears that Shanghai Disney was not the runaway success that Disney hoped that it would be. The major reason for the failure appears to be Disney's inability to promote its theme parks and business endeavors inside China's tightly-controlled media outlets.

After all, the only way that Disney is allowed to promote the park inside Communist China is through its unorthodoxed but very bizarre English-language educational schools, which they opened inside the mainland as a veiled and desperate attempt to promote its business interests without any media support.

Last time we checked, Disney was known only to be an entertainment company, not an philanthropic educational enterprise. Really? Where's the money in that kind of endeavor? We don't see these same kinds of schools in Japan, Hong Kong, or France, where Disney Channels were allowed to broadcast.

Also, it never made sense to us why Disney would open up a theme park in a region where the anticipated busy summer months are constantly drenched by Monsoon rains.

Disney has always picked locations for its theme parks based on it being a travel destination for tourists and, more importantly, having good weather all year round, especially during the crucial summer months which is considered all theme parks' traditional peak season.

Given the fact that the opening of Shanghai Disneyland in Red China also cannibalizing significant mainland business from one of Disney's many other major struggling international theme parks in Hong Kong, it appears that Disney's theme parks and resorts operations had a significantly off-year in 2016.

In fact, taken together with the complete collapse of Euro Disney in Disneyland Paris, it was a complete disaster on the international front for the House of Mouse.

Thus, it appears Disney's own crafted narrative about its runaway success in theme parks business in fiscal 2016 was all just smoke and mirrors.

While Disney is boasting a 9% increase in revenues year-to-year in its theme parks and resorts operations, this number is misleading because, for fiscal year 2015, Disney did not have the benefit of a sixth theme park resort in the form of the new Shanghai Disneyland to contribute to additional revenues.

|

| Visitors to Disney theme parks were down across the board especially in its international theme parks and resorts operations |

Thus, by this reasoning, Disney's theme parks operations underperformed by about 6.7% year to date.

This assumption is fair given the fact that their newest theme park in mainland China opened to a great deal of hoopla and publicity in the most populous and second most richest country on earth.

Thus, the downturn in overall attendance numbers in theme park attendance—especially in the international theme park operations—is quite concerning if we factor out the contributions from even the disappointing numbers from Shanghai Disneyland.

To give perspective to Shanghai Disney's "much-touted success" in drawing 11 million visitors in its first year of operation in the most populous country in the world, those numbers would rank Shanghai Disneyland alongside Disney World's least popular theme park, Disney's Hollywood Studios, in terms of popularity, whose admission ticket prices are 20-25% higher than in Shanghai.

| Shanghai Disney cannibalized a large number of Hong Kong Disney's visitors in 2016 |

After all, the only way that Disney is allowed to promote the park inside Communist China is through its unorthodoxed but very bizarre English-language educational schools, which they opened inside the mainland as a veiled and desperate attempt to promote its business interests without any media support.

Last time we checked, Disney was known only to be an entertainment company, not an philanthropic educational enterprise. Really? Where's the money in that kind of endeavor? We don't see these same kinds of schools in Japan, Hong Kong, or France, where Disney Channels were allowed to broadcast.

|

| We're not quite sure why Disney chose a region known for summer Monsoon rains |

Disney has always picked locations for its theme parks based on it being a travel destination for tourists and, more importantly, having good weather all year round, especially during the crucial summer months which is considered all theme parks' traditional peak season.

In fact, taken together with the complete collapse of Euro Disney in Disneyland Paris, it was a complete disaster on the international front for the House of Mouse.

Thus, it appears Disney's own crafted narrative about its runaway success in theme parks business in fiscal 2016 was all just smoke and mirrors.

While the New York Times has suggested that increased prices may have been the reason for the concerning drop in visitors across all Disney theme parks, that argument does not hold water given the fact that the same increased ticket prices did not affect Disney's direct competition, who seemed to have thrived last year in Disney's business fumbles and missteps.

|

| Markets reacted swiftly to the surprising news that attendance at all Disney theme parks were down last year |

Universal Studios Hollywood saw increased attendance numbers of 13.9% compared to the previous year. Universal's Islands of Adventure saw a 6.5% increase in attendance. Universal Studios Orlando jumped more than 4.3% in attendance from 2015. While Universal Studios Japan jumped more than 4.3% in attendance compared to the previous year.

The real reason for the declines, especially in Disney's international theme park operations, was that Disney's offerings in their theme parks became a bit stale and blase for many tourists, who preferred to look elsewhere, and for a better bang for the buck, than what Disney was offering.

Disney did make a very big mistake in increasing its ticket prices when they had very little that was new to offer in their theme parks, especially given the fact that they had put all their eggs in one basket in concentrating on the massive, but disappointing grand opening in their newest theme park and resort in Shanghai, China.

So it appears Disney's losses were Universal/Comcast's—and other Disney competitors'—gains.

Disneyland competitors in Southern California, such as Knott's Berry Farm and Six Flags Magic Mountain, also saw a rise in attendance, compared to the previous year. Knott's attendance rose 3.8%, while Magic Mountain saw 200,000 more visitors from the previous year, representing a 7.3% increase in visitors.

On the whole, Universal Studios parks in the U.S. saw a 7.5% increase in visitors, while attendance at Six Flags parks were up 4% and Cedar Fair parks were up 2.7%.

SeaWorld is still seeing some repercussions from its "Blackfish" scandal in Florida; however, its location in San Diego may have started seeing some recovery with a flat change in attendance from the year before.

This directly contradicts what Disney officials have been saying on quarterly earnings calls this past year with record profits in its theme parks and resorts division, so what exactly is going on with this apparent contradiction in the fortunes of Disney's second largest business segment?

| Disney's losses were Universal/Comcast's gains |

Disneyland competitors in Southern California, such as Knott's Berry Farm and Six Flags Magic Mountain, also saw a rise in attendance, compared to the previous year. Knott's attendance rose 3.8%, while Magic Mountain saw 200,000 more visitors from the previous year, representing a 7.3% increase in visitors.

On the whole, Universal Studios parks in the U.S. saw a 7.5% increase in visitors, while attendance at Six Flags parks were up 4% and Cedar Fair parks were up 2.7%.

SeaWorld is still seeing some repercussions from its "Blackfish" scandal in Florida; however, its location in San Diego may have started seeing some recovery with a flat change in attendance from the year before.

Well, the truth is: Disney has never been transparent with investors about its attendance numbers, which they have always willingly hidden during their quarterly earnings calls. So that gives them a great deal of license and latitude to play around with revenue and profit numbers to make their theme parks and resorts operations look better when the numbers really don't support the company's claims of such exaggerated and misleading success.

Disney can very swiftly reduce employee work shift hours of its parks and resorts employees and reduce hirings at a moment's notice to make their numbers look good, especially if one of their other business segments are not doing so well (e.g., media networks, movie studios, consumer products and digital interactive.)

|

| Disney theme parks appear to be more empty, especially in Paris and Hong Kong |

However, Disney's theme parks and resorts operations were in line with these underperforming numbers, but Disney executives quickly manipulated its staffing needs to make its second largest business segment look like it was performing better than it actually was.

But now that we have a more truthful glimpse of their actual attendance numbers, the rosy picture at Disney's theme parks and resorts operations is not that rosy as Disney executives want it to appear after all. We anticipate the news will cause a rough trading day for Disney on Wall Street tomorrow.

Here are the top 25 theme parks worldwide in 2016 and their percentage attendance changes from the year before:

Here are the top 25 theme parks worldwide in 2016 and their percentage attendance changes from the year before:

- Walt Disney World Magic Kingdom, 20,395,000, -0.5%

- Disneyland, 17,943,000, -1.8%

- Tokyo Disneyland, 16,540,000, -0.4%

- Universal Studios Japan, 14,500,000, 4.3%

- Tokyo DisneySea, 13,460,000, -1.0%

- Epcot, 11,712,000, -0.7%

- Disney's Animal Kingdom, 10,844,000, -0.7%

- Disney's Hollywood Studios, 10,776,000, -0.5%

- Universal Studios Florida, 9,998,000, 4.3%

- Islands of Adventure, 9,362,000, 6.5%

- Disney California Adventure, 9,295,000, -0.9%

- Chimelong Ocean Kingdom, 8,474,000, 13.2%

- Disneyland Paris, 8,400,000, -14.2%

- Lotte World, 8,150,000, 11.5%

- Universal Studios Hollywood, 8,086,000, 13.9%

- Everland, 7,200,000, -3.0%

- Hong Kong Disneyland, 6,100,000, -10.3%

- Ocean Park, 5,996,000, -18.8%

- Nagashima Spa Land, 5,850,000, -0.3%

- Europa Park, 5,600,000, 1.8%

- Shanghai Disneyland, New 5,600,000 (Opened in June)

- Walt Disney Studios Paris, 4,970,000, -1.6%

- Efteling, 4,764,000, 1.8%

- Tivoli Gardens, 4,640,000, -2.0%

- SeaWorld Orlando, 4,402,000, -7.9%

Sources:

- Madison: Here's What's Wrong With Walt Disney World (6/17/17)

- Skift: Disney Attendance Dips While Harry Potter Keeps Universal Soaring (6/05/17)

- Cosmopolitan: Worldwide Disney Park Attendance Drops Because of Rising Prices (6/04/17)

- WIBW: Report: Disney has slight visitor declines at parks (6/04/17)

- Inquisitr: Theme Park Report Has Walt Disney World Attendance Down At All U.S. Parks In 2016, Universal's Numbers Rise (6/02/17)

- Motley Fool: 3 Ways Disney World's Top Rival Keeps Closing the Gap (6/02/17)

- Money: Attendance at Disney parks is down for the first time in a decade (6/02/17)

- NY Post: High prices at Disney parks hit attendance last year (6/02/17)

- Daily Mail: Disneyland Paris hit by drop in visitor numbers (6/02/17)

- StockNews: Price Hikes Hurt Attendance At Walt Disney Co (DIS) Theme Parks (6/02/17)

- Fortune: Fewer People Went to Disney Theme Parks in the U.S. Last Year (6/02/17), with video

- NY Times: Attendance Drops at Disney Parks Worldwide as Prices Rise (6/01/17)

- LA Times: Harry Potter boosts Universal Studios attendance; Disneyland visits slip (6/01/17)

- LA Biz: Harry Potter boosted Universal Studios attendance, while Disneyland saw a drop (6/01/17)

- OC Register: Harry Potter boosts Universal Studios Hollywood’s 2016 attendance; Disneyland number dips (6/01/17)

- Theme Park Insider: Disney parks slip, but remain atop global theme park attendance report (6/01/17)

- Attractions Magazine: 2016 TEA/AECOM theme park attendance report now available (6/01/17)

- Miami Herald: Harry Potter keeps drawing more visitors but Disney World has small drop in attendance (6/01/17)

- Bloomberg: Harry Potter's Magic Helps Universal Parks Gain as Disney Slows (6/01/17)

- Inside the Magic: TEA 2016 theme park attendance report reveals big year for Universal Studios, but Disney remains on top (6/01/17)

- Orlando Sentinel: Disney World attendance down in 2016, report says (6/01/17), with video

- Mickey-Leaks: Disney's earnings call misses for the fourth time in the last five quarters, sending its stock plummeting (5/09/17)

- TTG Asia: Tokyo Disney attendance dips as Universal numbers go up (5/04/17)

- Hollywood Reporter: Universal Studios Japan Admissions Hit Record 14.6M, Tokyo Disneyland Numbers Fall Again (4/03/17)

- Mickey-Leaks: Disney World to pay $3.8 Million back to workers over federal minimum wage and overtime labor violations (3/17/17)

- Mickey-Leaks: Hong Kong Disneyland's 2016 losses confirm that Disney's international theme park operations are a complete flop (2/25/17)

- LA Times: Hong Kong Disneyland reports a 2016 loss as visitor slump worsens (2/21/17)

- Nikkei Asian Review: Hong Kong Disneyland hopes for 'slow turnaround' after second year in red (2/21/17)

- ABC News: Hong Kong Disneyland posts 2016 loss on tourism softness (2/20/17)

- Theme Park Insider: What does Hong Kong Disneyland need to reverse its slide? (2/20/17)

- CTV News: Hong Kong Disneyland posts 2016 loss on tourism softness (2/20/17)

- South China Morning Post: Hong Kong Disneyland records loss for second year in a row, as mainland visitor numbers dwindle (2/20/17)

- Mickey-Leaks: Disney's ticket price hikes on Sunday will push down park attendance in 2017 even more than last year (2/12/17)

- Mickey-Leaks: Mickey's money pit: Disney bails out Euro Disney again with $2 billion cash injection and increases its own stakes before an imminent financial collapse (2/10/17)

- Telegraph: Walt Disney Company to bail out struggling European sister (2/10/17)

- LA Times: Disney to invest big money on a struggling Euro Disney (2/10/17)

- USA Today: Walt Disney seeks control of financially-troubled Euro Disney (2/10/17)

- Fortune: Walt Disney Seeks Control of Troubled Offspring Euro Disney (2/10/17)

- CNN: Disney bails out European theme park again with $2 billion (2/10/17), with video

- Mickey-Leaks: Disney Q1 woes: Profits drop 14% and revenues slide 3% as all business segments report declines in sales (2/07/17)

- Skift: Disney Deep Dive: The Economics of Hong Kong Disneyland Resort (1/18/17)

- Mickey-Leaks: Tourism dries up at Shanghai Disneyland as visitors complain of high prices and poor service on social media inside mainland China (1/01/17)

- Paste: Hong Kong Disneyland’s in Some Deep Shit (12/01/16)

- Mickey-Leaks: Disney ends fiscal 2016 on an ominously sour note (11/29/16)

- Mickey-Leaks: Disney in serious trouble as they miss earnings projections for the second time in the last three quarters (11/10/16)

- Mickey-Leaks: Disney doubles down on claims that Disney World has seen no fallout from the Zika scare despite a notable drop in park attendance (9/16/16)

- Mickey-Leaks: 5 Reasons Disney World Lost This Summer (9/5/16)

- Mickey-Leaks: We told you so! Disney stocks drops to its lowest point in 7 months since Aug. 9th's third-quarter earnings call (9/1/16)

- Mickey-Leaks: Judgment day: Quarterly earnings for Disney largely disappoint as predicted and result in a drop in Disney stock prices in after hours trading (8/09/16)

- Mickey-Leaks: Bearish forecasters brace for Disney stock to tank as earnings expected to fall well short of Wall Street expectations again during Disney's next quarterly earnings call (8/03/16)

- Mickey-Leaks: 5 Reasons Disney World Attendance is Falling (7/31/16)

- Mickey-Leaks: Orlando tourist destinations start summer on a sour note (6/30/16)

- Mickey-Leaks: Brexit, Zika, Brazil, and upcoming Rio Summer Olympics—but not so much gators—slam prospects of tourism to Disney World and send Disney stocks plummeting downward (6/25/16)

- Mickey-Leaks: Disney's failure to reach a deal with Beijing in establishing a significant media presence inside China may sink its hopes for success in its $5.5B 'distinctly communist' theme park (6/19/16)

Comments

Post a Comment