The wheels are coming off Disney's cable bundle business model as kids too are tuning out Disney's cable channels in droves

| Disney Channels President, Gary Marsh, under fire this week for plummeting rating in all Disney cable TV properties |

|

| Viewership is dropping across all Disney cable TV properties |

This pretty much confirms that Disney's consumer unfriendly cable bundle business model, which has fueled much of Disney's stock price takeoff over the last decade, is completely unraveling at the seams and may cause Disney's stock prices to tumble back down to $95 per share, according to some Wall Street experts.

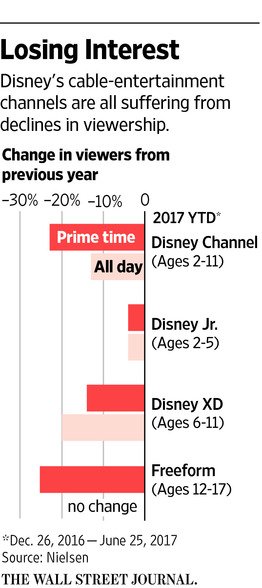

The Wall Street Journal noted that, based on the ratings data from A.C. Nielsen, prime-time viewing for ages 2 to 34 has declined 34% during the past five years.

In addition, among its key 2 to 11 and 6 to 14 target age demographic audiences, ratings for the Disney Channel plummeted 23% in prime time and 13% and 18%, respectively, during the day, compared to the same period a year ago.

Freeform's prime time viewership among the key demographic age group of 12 to 17 was down 25%, while viewership for 18 to 34 age demographic dropped more than 20% from the same period from December to June compared to a year ago.

These anemic numbers are consistent and across the board on the Disney Channel, Freeform, Disney Jr., and Disney XD networks, so it represents a landslide fall in ratings on Disney's entire cable TV lineup.

SNL Kagan, an cable industry consulting firm, also confirmed to the WSJ that the Disney Channel and Freeform both lost about 4 million subscribers each over the last three years.

This is very concerning for Disney because when taken in context with larger losses already reported at their single most profitable business entity, ESPN, it pretty much confirms that Disney's largest and most profitable business unit, its cable television networks, is floundering from an industry-wide disruption due to the cord-cutting phenomena.

An astounding 30% of Disney's revenues and a whopping 43% of its profits come from its cable television business, which roughly translates to one-third of Disney's revenues and nearly half of all their profits.

While only 23% of cable revenues and profits come from its kids-oriented cables channels, the vast majority of the rest comes from ESPN. However, when a viewer exodus across all of Disney's cable television properties all begins to slide together in unison, it pretty much confirms the fact that Disney's goose that laid the golden eggs, its cable bundle business model, is dying with little else to show any viable business opportunities for future growth in its other business segments.

Thus, cord-cutting is a major problem for Disney in more ways than one because it was (and still is) the engine that drove booming profits for the House of Mouse.

In the booming age of YouTube and streaming video services like Netflix, Amazon Prime, and Apple TV, younger generations of viewers are much less inclined to watch cable TV in the same way that previous generations used to.

They are much quicker to migrate their viewing habits to mobile devices and online streaming video services provided on-demand on the internet than other key age demographics.

They are much quicker to migrate their viewing habits to mobile devices and online streaming video services provided on-demand on the internet than other key age demographics.That's because the newer generations of viewers are much more apt to embrace technological advancements and changes much sooner than the older generations of viewers.

Disney executives continue to say they are still trying to determine how aggressively they want to make their content available on mobile and online formats, but they've always said that with very little real intention on making the leap.

"We see the migration," Disney Channel President Gary Marsh told the WSJ disingenuously. "One of the challenges is trying to serve the viewership where they're going as opposed to trying to drive them where we want them to go."

Unfortunately for Disney, they are pretty much stuck in a rut with their antiquated cable-bundle business model for all their cable channels and cannot adapt to the quickly changing digital media landscape, even if their very lives depended on it, which it pretty much does at this point.

That's because, as New York Times columnist James Stewart puts it, "They [Disney] are never going to have another cash-cow like the cable situation." (See video above.)

| Disney hasn't bottomed out yet as its next quarterly earnings call is coming up soon |

Under this model, the content provider is king rather than the consumer, and Disney has been able to use this consumer-unfriendly business model to print money, hand over fist, even without having to draw actual cable TV viewers to their cable channels to justify their cable carriage fees as part of the cumbersome cable bundle package.

Online streaming video services, on the other hand, can only justify their revenue from the actual number of viewers that subscribe and pay for a particular channel or show on the market, so the consumer is king.

Thus in the digital media landscape of the future, content providers cannot count on printing money from just being part of a bundled package deal as they had done in the past with the old cable bundle package model.

This is a very big problem for Disney because many of their business enterprises are also synergistic and interconnected to their media networks division from the old cable bundle business model. Much of their movie, consumer products, video interactive, and theme park businesses are heavily promoted through their media networks properties.

Declining viewership on all its media networks segment also means less opportunity to advertise and promote other Disney merchandise, products, entertainment offerings, vacation packages, and services. This is, and has always been, the major driver of revenue for the company.

And now that Disney's cable TV business is evaporating due to industry-wide disruptions of the media landscape from the tech world, it could unravel everything at the house that Mickey built because its media networks operations are at the very heart of the company's media-merchandise-theme parks business.

| |

| Children, more than any other demographic, are more prone to adopting new technology |

Is this the beginning of the end of cable television as we know it? It sure seems like it.

Even the on-demand pay streaming video service business may soon be under pressure as streaming video piracy sites have been able to provide virtually any television show or movie online for free without any charge to speak of to the consumer.

These three bits of bad news for media companies everywhere may explain why so many investors are now concerned over the future of the Walt Disney Company.

Sources:

- InvestorPlace: Walt Disney Co (DIS) Stock Is On the Ropes Amid Technical Breakdown (7/06/17)

- Motley Fool: The Walt Disney Company: The Bear Case From a Bull (7/06/17)

- Digital Chew: Disney Channels Ratings Drop by Double-Digits (7/06/17)

- The Australian: Children starting to tune out of Disney’s cable TV channels (7/06/17)

- Investopedia: Disney: Declining Cable Ratings Raise Concerns (7/05/17)

- Fast Company: Basically, no one wants to watch the Disney Channel anymore (7/05/17)

- NewsOK: Disney Channel struggles to survive against streaming services (7/05/17), with video

- Tubefilter: Disney Channel And Freeform Ratings Are Falling As Young Viewers Turn To Streaming Platforms (7/05/17)

- Decider: Disney Is Bleeding Its Audience As the Kids Are Flocking to Streaming (7/05/17)

- Axios: Viewers are abandoning Disney's channels (7/05/17)

- Laughing Place: Disney Channel, Freeform Shedding Subscribers — Direct-to-Consumer App Coming Soon? (7/05/17)

- TheStreet: The Disney Channel Has Lost an Astounding Number of Subscribers (7/04/17), with video

- Fox Business: Disney's Channels: Kids Are Tuning Out -- Update (7/04/17)

- WSJ: Disney’s Channels: Children Are Tuning Out (7/04/17), with video

- Seeking Alpha: Disney On Its Way Back To $95 A Share (7/04/17)

Comments

Post a Comment