Disney's earnings call misses Wall Street expectations again for the fifth time in the last six quarters, sending its shares plummeting

|

| Disney stock prices again plummeted in after hours trading after Disney announced yet another disappointing quarterly earnings call to Wall Street investors |

The House of Mouse posted very weak earnings of $1.51 per share on revenues of $14.24 billion which were again below Wall Street expectations for a consensus EPS of $1.55 on $14.42 billion in expected revenue.

This is the fifth time in the last six fiscal quarters that Disney missed Wall Street expectations in earnings, which sent investors scurrying, and Disney shares plummeted by more than 3% immediately in after hours trading and 5% on Wednesday after the opening bell to their lowest point in over eight months.

| ESPN continues to dominate the news about why Disney is failing to meet Wall Street expectations for earnings, suggesting it is still a big problem for Disney |

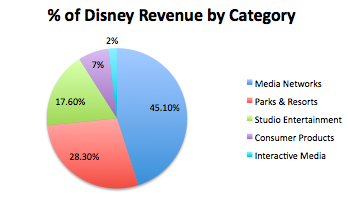

Breaking down the numbers by segments, studio entertainment revenue was down a whopping 16% to $2.393 billion with the unit's operating income tumbling more than 17%. Consumer products and interactive media revenue slipped 5% to $1.085 billion. Media networks revenue slid 1% to $5.866 billion. But on what looked to be the up-side, parks and resorts revenue reported revenues up about 12% to $4.894 billion.

|

| Disney shares plummeted by more than 5% on the opening of the trading day this morning after the weak quarterly results announced yesterday |

By this assumption, the theme parks and resorts segment actually underperformed by at least 4%, when trying to take the added expected contributions from Disney's newest theme park and resort in mainland China into account.

Disney, however, is reporting its theme park numbers to be a great success. The Themed Entertainment Association (TEA), on the other hand, reported contradictory metrics to what Disney officials were claiming yesterday as an unexpected windfall from their supposedly growing theme parks operations last year.

Just a few months ago, the annual TEA report on attendance at theme parks showed that attendance numbers dipped in all Disney theme parks worldwide last year, with notable double-digit declines in attendance numbers particularly at Disney's long-struggling international theme park resorts, namely Hong Kong Disneyland and Disneyland Paris.

|

| Mickey Mouse is officially down and out with a whole year and a half of weak fiscal results and a clear pattern of declining revenues |

Disney recently bailed out Disneyland Paris in February to the tune of $2 billion after the park flopped from fears of continuing threats from terrorism on the European continent, and Disney also injected a similar $1.4 billion bail out in Hong Kong Disney within the same month after that theme park flopped, suggesting that there is really nothing to celebrate about Disney's international theme parks and resorts unit at all.

If there was really anything to celebrate about Shanghai Disneyland's first year of operations, which we believe there wasn't, it was completely wiped away by how Shanghai Disney cannibalized mainland business away from Disney's other struggling Chinese theme park, Hong Kong Disneyland.

What Disney officials claim as a success simply cannot be believed anymore on face value by wary investors.

|

| Disney is realizing that Netflix is a serious threat to its cable TV businesses, so the House of Mouse is trying to launch its own video streaming services to compete |

Revenues for cable networks division, in particular, slid by more than 3% to $4.1 billion, and more shockingly, operating income for the media networks segment, as a whole, plunged by more than 23% to $1.5 billion.

This was the fifth straight fiscal quarter in a row that the unit's operating income declined year-over-year.

Disney largely blamed its struggling behemoth ESPN, which has long been the sole driving profit engine for the company, for the very noticeable decline.

| Are Hollywood media giants that are purely content providers, like Disney, becoming like dinosaurs in the digital age of distribution? |

Thus, the declining value of Disney stocks, based on even more bad news of ESPN and Disney's cable networks continuing to falter, suggests that the markets are still continuing to correct for the phenomenon of cord-cutting into Disney's market cap, which apparently is still a very active and ongoing factor that has yet to be even slightly abated.

This basically proves that the ESPN situation hasn't yet come close to bottoming out for Disney shares on Wall Street.

What's most disturbing of all is the fact that Disney's most recent, strongest performing business segment, studio entertainment, posted its biggest declines in revenue, 16%, and operating income, 17%, this quarter.

|

| Disney's revenue breakdown by segments |

As part of the new streaming video services, Disney announced it paid $1.58 billion for a majority stake in Bamtech, a video streaming company developed by Major League Baseball (MLB) to live-stream MLB baseball games online, which Disney will use to develop both of its proposed video streaming platforms.

Disney CEO Bob Iger was forced to make the bold announcement on the dramatic shift in Disney's business strategy to try to shake things up at the slumping media giant and distract worried investors away from Disney's many pressing business problems.

“We continue to see more erosion of general subscribers in the traditional business,” Diedrich said. “That is the concern and probably what was pushing them to do this sooner rather than later.”

Unfortunately for Disney, the rouse didn't work, as Disney shares continued to plummet this morning on the uncertainties the plan will bring. The plan announced by Iger was half-baked from its very inception with very little of the financials actually worked out at the time of the announcement.

With the not-too-surprising nor welcomed announcement, however, Disney also had to announce another bombshell it dropped saying it would end its existing distribution agreement with Netflix for distributing its new movies, beginning with the 2019 calendar year theatrical releases, as Disney will begin directly competing against the online video streaming media giant on Netflix's home turf on the internet.

Curiously enough, Disney will continue to honor its development deal for new programming on Netflix, which includes several Marvel TV projects. No one is certain if the Disney announcement of launching its own start-up video streaming services were a result of Disney failing to make a deal to acquire Netflix, which had been rumored on Wall Street for quite a while.

|

| Disney's bombshell announcement Tuesday was to cut off its nose to spite its face |

It's not only a desperate strategic move that can clearly be considered a "Hail Mary," but it's an unsound business move with no details worked out that reeks of rushing to cut one's own nose off to spite one's face.

Disney has literally shot itself in the foot, but what other choice did it have? The writing has clearly been on the walls for some time now, and no one at the House of Mouse, including CEO Bob Iger, has come up with any solution to stem the tide of the media giant's inevitable and impending demise from digital online disruption of its studio entertainment and media networks segments.

Sources:

- TheStreet: A Former Netflix Exec Reveals the Real Reason Why Disney Probably Dumped Netflix (8/16/17), with video

- Seeking Alpha: Disney's Media Slip 'N Slide (8/16/17), with video

- Hollywood Reporter: Can Disney Create a Netflix of Sports? (8/16/17)

- InvestorPlace: Why it’s Time to Sell Walt Disney Co (DIS) Stock (8/15/17)

- U.S. News & World Report: Can Streaming ESPN Solve Disney (DIS) Stock's Problems? (8/14/17)

- Decider: Media Analyst Rich Greenfield Believes The Disney and ESPN Streaming Services Will Face An Uphill Fight Against Netflix and Amazon (8/14/17)

- Seeking Alpha: Disney: Losing The Magic? (8/10/17)

- CNBC: Media execs frustrated with Iger's swan song plan for multiple Disney direct-to-consumer platforms (8/10/17), with video

- TheStreet: Sell Disney. Sell Netflix. Sell It All! (8/09/17), with video

- Money: Disney and Netflix Stocks Are Both Taking a Beating After Their Breakup (8/09/17)

- Orlando Weekly: Disney stocks take a hit after announcing split with Netflix (8/09/17)

- Reuters: Disney's stock dips as streaming push unnerves some investors (8/09/17)

- Fox Business: Disney shares on track for worst day since May 2016 amid ESPN issues (8/09/17), with video

- The Hollywood Reporter: Walt Disney, Netflix Stocks Drop on Streaming Deal News (8/09/17), with video

- NY Post: ESPN is dragging down Disney’s stock (8/08/17)

- NY Times: How Disney Wants to Take On Netflix With Its Own Streaming Services (8/08/17)

- LA Times: Disney to offer two streaming services and end its movie distribution agreement with Netflix (8/08/17), with video

- Orlando Sentinel: Shanghai and Paris drive Disney park revenue growth (8/08/17), with video

- CNBC: Disney says ESPN contributed to 23% drop in cable operating income (8/08/17), with video

- Fortune: Why Netflix and Disney Stocks Are Both Plummeting Right Now (8/08/17), with video

- Business Insider: Disney slides after missing on revenue and ending its streaming agreement with Netflix (8/08/17)

- Nasdaq: Disney (DIS) Shares Slump as Q3 Revenues Miss Expectations (8/08/17)

- Bloomberg: Disney Sales Miss Forecasts on Weaker Revenue From TV Channels (8/08/17), with video

- The wheels are coming off Disney's cable bundle business model as kids too are tuning out Disney's cable channels in droves (7/06/17)

- Re/Code: Why Disney made a huge mistake by selling its content to Netflix (6/15/17)

- All Disney theme parks' attendance numbers are down, industry study reports (6/01/17)

- Disney's earnings call misses for the fourth time in the last five quarters, sending its stock plummeting (5/09/17)

- Signs of deep trouble at the 'Happiest Place on Earth' emerge as Disney announces another major round of layoffs at ESPN and Maker Studios (3/09/17)

- Hong Kong Disneyland's 2016 losses confirm that Disney's international theme park operations are a complete flop (2/25/17)

- Disney's ticket price hikes on Sunday will push down park attendance in 2017 even more than last year (2/12/17)

- Mickey's money pit: Disney bails out Euro Disney again with $2 billion cash injection and increases its own stakes before an imminent financial collapse (2/10/17)

- Disney Q1 woes: Profits drop 14% and revenues slide 3% as all business segments report declines in sales (2/07/17)

- Disney's ESPN is now officially tanking as the all-sports cable giant lost 1.18 million subscribers in just the last two months (1/08/17)

- Tourism dries up at Shanghai Disneyland as visitors complain of high prices and poor service on social media inside mainland China (1/01/17)

- The unthinkable is now being talked about on Wall Street: Disney should spin off ESPN to help Disney's stock valuation (12/05/16)

- Disney ends fiscal 2016 on an ominously sour note (11/29/16)

- Disney in serious trouble as they miss earnings projections for the second time in the last three quarters (11/10/16)

- Disney's cable demise begins: DISH offers Sling with and without ESPN, effectively making it à-la-carte, so Disney is now scrambling to find a new digital distribution strategy (10/14/16)

- As DIS stock prices continue to slide, Disney ponders acquiring a multi-billion dollar high tech media company to reassure investors that its best days are not behind them (10/11/16)

- 5 Reasons Disney World Lost This Summer (9/5/16)

- We told you so! Disney stocks drops to its lowest point in 7 months since Aug. 9th's third-quarter earnings call (9/1/16)

- Judgment day: Quarterly earnings for Disney largely disappoint as predicted and result in a drop in Disney stock prices in after hours trading (8/09/16)

- Bearish forecasters brace for Disney stock to tank as earnings expected to fall well short of Wall Street expectations again during Disney's next quarterly earnings call (8/03/16)

- 5 Reasons Disney World Attendance is Falling (7/31/16)

Comments

Post a Comment